When Trust Becomes Your Competitive Advantage

The best offshoring partnerships don’t start with spreadsheets. In the early 2000s, a London Stock Exchange-listed financial services company approached a software development firm for an automated parsing solution. During the project, they discovered the vendor had robust offshoring capabilities and, more importantly, had built a foundation of trust through their initial engagement. That relationship led to establishing a 250-person center in Delhi—a massive success that transformed both organizations.

Most companies aren’t this fortunate. They don’t stumble into the right partner while working on an unrelated project. Instead, they face a crowded marketplace where vendors spring up daily, each promising lower costs and faster delivery while undercutting one another on price.

The Selection Paradox

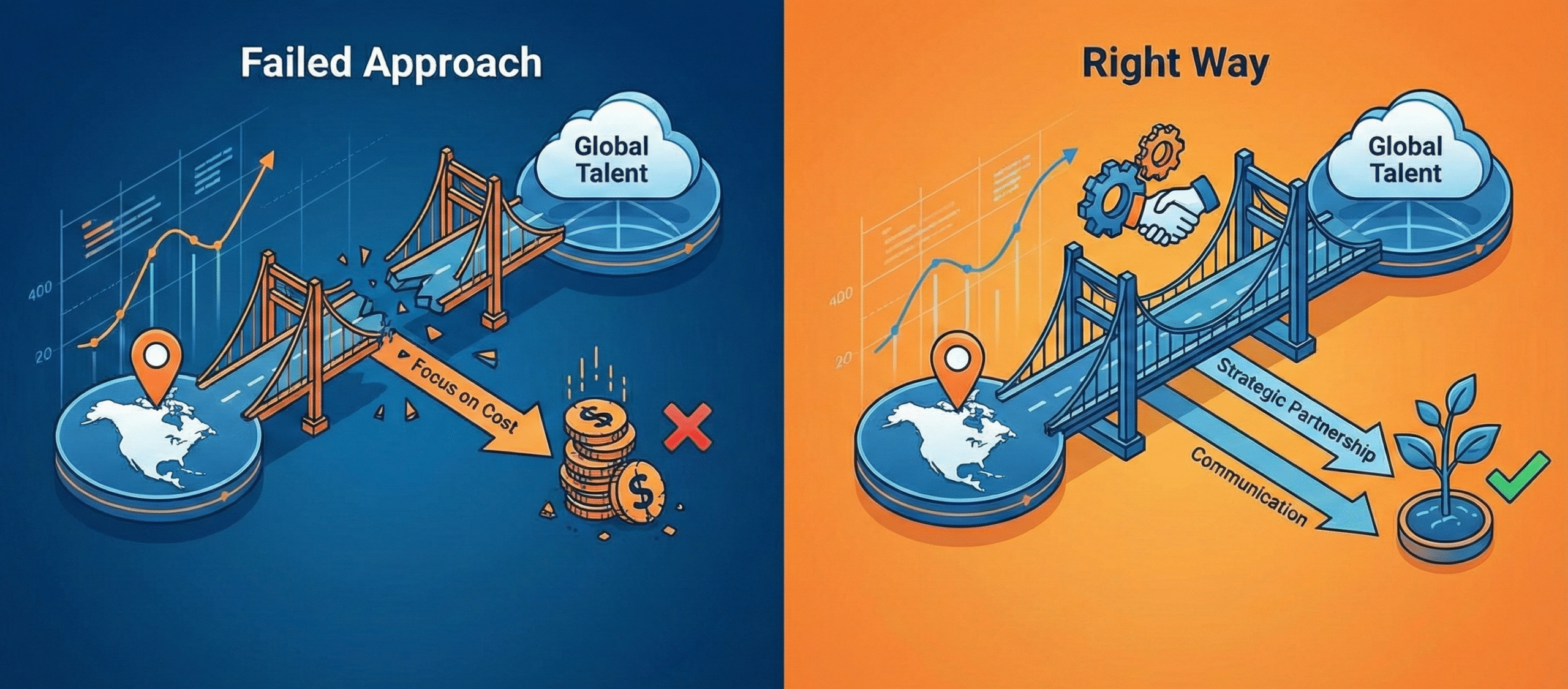

Here’s the uncomfortable truth: choosing an offshoring partner based primarily on cost is like hiring a CFO based solely on their hourly rate. Yet that’s exactly how many firms approach the decision.

Smart selection requires evaluating factors that don’t appear on a rate card. Background checks matter, but so does local presence—does your potential partner have boots on the ground who understand both markets? Communication skills aren’t just about English proficiency; they’re about cultural fluency and the ability to translate business context across time zones.

Equally important is the exit strategy. Can you extricate yourself if the arrangement doesn’t work? Too many firms lock themselves into rigid contracts without considering what happens if the partnership falters. The best arrangements build in flexibility from day one.

The Real Reason Offshoring Fails

Technical capability isn’t the problem. The talent exists. The infrastructure is there. Major investment banks, technology giants, and consulting firms have proven this repeatedly with their large-scale operations in India and other offshore hubs.

The failure point is almost always organizational, not operational.

Companies that succeed with offshore centers do so because they’ve built one seamless unit, not “us and them.” They’ve overcome time zone challenges and communication barriers by fully integrating their teams. Decision-making flows naturally. Information moves freely. The offshore team feels like an extension, not an outsourced afterthought.

But many organizations never reach this level of integration. Despite hiring talented professionals, they retain a subtle hierarchy where critical work stays onshore. The message—spoken or unspoken—is clear: the offshore team handles execution, not strategy. They’re doers, not decision-makers. And often, they’re assigned the low-complexity work that doesn’t stretch their capabilities.

This creates a predictable spiral. Talented employees grow frustrated with limited scope. They sense they’re not trusted with meaningful work. Motivation erodes. Turnover increases. The main office points to the turnover as evidence that offshoring “doesn’t work,” missing the fact that they created the problem through their own reluctance to let go.

When teams operate in silos, communication breaks down. Finger-pointing increases. What could have been a strategic advantage becomes a liability.

The Trust Gap: Then and Now

Twenty years ago, hesitation about offshoring was understandable. Companies worried about working across vast cultural and geographic distances. Time zones seemed insurmountable. Communication technology was limited.

But the chief concern was always data security. Executives resisted sending confidential information outside their firewalls. Perceptions about data protection standards in countries like India fueled anxiety—some of it rooted in outdated stereotypes about infrastructure and governance.

Fast forward to today. Every major financial institution, investment bank, and technology company has significant operations in India. Those initial concerns have been addressed through experience, improved infrastructure, robust regulatory frameworks, and proven track records. The fears have been put to rest.

Yet first-timers still face the same mental barriers. They see others succeeding but wonder: Are we ready? Despite an increasingly connected world, lingering perceptions remain—concerns about bureaucracy, corruption, or operational challenges that may have been valid decades ago but don’t reflect current reality.

This hesitation causes paralysis. Offshoring remains a “nice-to-have” rather than a “must-do.” Firms delay until competitive pressure forces their hand, by which point they’ve surrendered first-mover advantage.

The irony? Once companies take the initial step—particularly with the right partner to guide them—they wonder why they waited so long. The water isn’t as cold as it looked from the shore.

Flexibility Changes Everything

The assumption that setting up an offshore operation requires months of planning, major capital investment, and complex entity formation stops many firms before they start. Analysis paralysis takes over.

But it doesn’t have to be this way.

The model you choose should match your needs, timeline, and risk tolerance. A captive entity —where you own and operate your offshore office—offers maximum control and long-term cost benefits. For larger teams (50+ employees), this model makes sense. You control the culture, processes, and strategic direction completely.

However, captive entities require significant upfront investment: entity registration, office leases, HR infrastructure, compliance management, and local leadership. For a five-person team, this overhead often outweighs the benefits.

This is where flexible models shine. Co-working spaces and managed team arrangements allow you to be operational in days, not months. Reputable providers offer customized agreements that can literally be signed overnight if you have employees ready. If you need to hire, many partners handle recruitment quickly.

The key advantage? Exit flexibility. If offshoring doesn’t deliver the expected value—or if your business circumstances change—you can exit without being saddled with long-term leases, employment obligations, or legal entities to unwind.

A real example: during a contentious merger, one organization needed to set up workspace overnight for a 20-person team that suddenly lost access to their office when it was taken over by one of the acquiring parties. Using a flexible co-working arrangement, they resumed operations the next morning without missing a beat.

Start Small, Scale Smart

The most successful offshoring strategies don’t begin with grand visions of 200-person centers. They start with a pilot.

Choose non-critical work initially—tasks that are important but not mission-critical. This allows both sides to build trust, understand working styles, develop communication rhythms, and refine processes. Learn what works before scaling.

As confidence builds, gradually expand scope. Assign more complex work. Include offshore team members in strategic discussions. Give them ownership over outcomes, not just tasks.

This approach requires patience and empathy. Like any relationship, trust takes time. But the firms that embrace this mindset—that view their offshore teams as true partners rather than vendors—unlock transformational value.

Done right, offshoring isn’t just about cost savings. It’s about accessing global talent, building organizational resilience, and creating competitive advantages that compound over time. The question isn’t whether to offshore. It’s whether you’re ready to do it right.

(Anil Nair is a partner of Accsera (USA) and a thought leader in offshoring and has setup several successful offshoring partnerships)